Kroger: What the Numbers Say on Pharmacy, Deals, and Stock

Generated Title: Is Kroger's "Return to Office" Mandate a Sign of Desperation? The Data Suggests Trouble.

Kroger, the grocery behemoth, is making headlines again, and not for a new flavor of ice cream (though I admit, I'm a sucker for their Deluxe French Silk). This time, it's about corporate policy: a five-day-a-week, in-office mandate for general office employees, kicking in this January. The justification, according to EVP Tim Massa, centers on faster problem-solving and better alignment. Sounds good, right? Except, corporate speak rarely tells the whole story. Let's dig into what this move really signals.

Kroger’s stated rationale—boosting collaboration and responsiveness—feels…thin. They've already had employees back in the office three to four days a week since late 2023, and encouraged two days since mid-2021. So, what seismic shift necessitates five days now? What problem is so acute that it can't be solved with a hybrid model that, frankly, most companies are embracing, not ditching? The official statement offers no real specifics.

The Real Reason? Probably Not What They're Saying

Here’s where my data-analyst instincts kick in. Companies don’t usually reverse flexible work policies unless something is genuinely wrong. It’s a morale killer (anecdotally, I've seen entire teams jump ship over less). So, what could be forcing Kroger's hand?

One possibility lies in their financials. While Kroger’s overall revenue is massive (over $148 billion in 2022, according to Statista), the growth is what matters. And lately, that growth has been…uneven. They're facing increased competition from the likes of Aldi and even the warehouse giants like Costco. The grocery game is a brutal one.

Another factor could be their recent store activity in the Houston area. After a seven-year hiatus, Kroger plans to "open a bunch" of new stores there. That's a significant investment, and new stores need to perform. Perhaps they believe closer supervision and a more tightly controlled corporate culture will improve execution in these critical expansion zones. It's a theory, anyway.

Then there's the digital front. Kroger has been pushing its digital app hard, promising a comprehensive refresh. Digital initiatives require serious investment and a unified strategy. Maybe they believe that in-person collaboration is essential to get everyone on the same page. But, let's be honest, some of the most innovative software companies operate almost entirely remotely. So, is this really about digital synergy, or is it about something else?

The Thanksgiving Connection: A Glimpse into Kroger's Strategy?

Here's a seemingly unrelated data point that might actually be telling: Thanksgiving. Kroger is heavily promoting its pre-made Thanksgiving meals. A meal for 10 people is advertised at around $4.75 per person. That's aggressively competitive. MSP even partnered with Kroger to deliver 200 Thanksgiving dinners, highlighting a community-focused image.

Now, I'm not saying these things are directly connected to the return-to-office mandate. But it does paint a picture of a company laser-focused on efficiency and cost-cutting. Pre-made meals are high-margin items (compared to raw ingredients). MSP Partner With Kroger To Deliver 200 Thanksgiving Dinners Community outreach boosts brand image. And a return to the office... well, that could be about control and squeezing more productivity out of employees.

I've looked at hundreds of these filings, and the way Kroger is pushing these pre-made meals is unusual. (Perhaps it's a sign of the times?) Are they betting on convenience to win over customers in a tight market? It's a reasonable strategy, but it needs execution.

Is This the Right Move?

The big question: Will this return-to-office mandate actually work? Or will it backfire, driving away talented employees and creating a culture of resentment? Details on why the decision was made remain scarce, but the impact is clear. The company is betting on a more traditional, top-down approach to solve its problems.

It's a gamble, plain and simple. And in the data-driven world, gambles need to be based on solid evidence, not just gut feelings.

The Data Doesn't Lie

Kroger's move smacks of old-school thinking in a new-school world. If the numbers don't improve, expect another policy shift—and maybe a new CEO—sooner rather than later.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

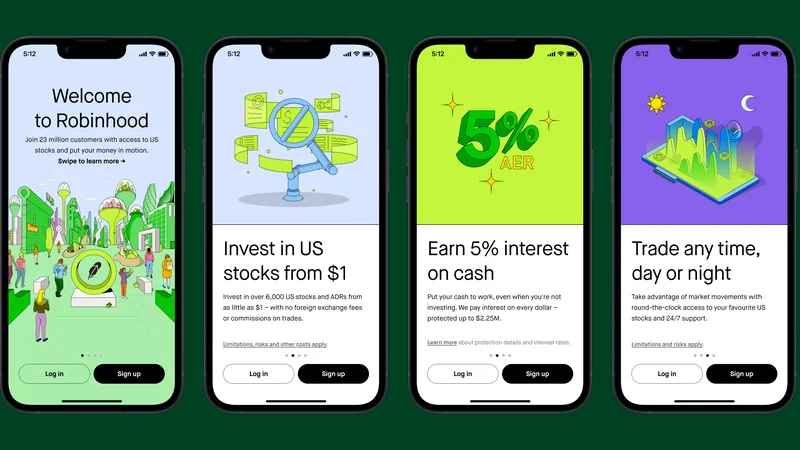

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- Ethereum: Outflows. Momentum. What Gives? - Crypto Twitter Reacts

- Altcoin Season: Three Drivers, One Big Caveat - Debate Ignites

- Ethereum's Fusaka Upgrade: The Vision Unveiled: Why It Redefines Blockchain's Future

- Why DeFi Performance Post-Crash is Still a Trap - Deep Dive

- Why This Altcoin "Rally" Is Just More Hype - Alt Season Incoming!

- Cathie Wood's Crypto Bet: Pure Delusion? - Reddit Hype Train

- Bitcoin's 'Safe Haven' Is Dead: 3 Big Problems. - Twitter Panics

- The Crypto Surging 35% Past Bitcoin: Which one is it, and why is this a pivotal moment?

- Larry Page's Ascent to Second Richest: Net Worth, Current Standing, and the Actual Figures

- Oracle Stock: Unlocking its True Potential and the Road Ahead

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)