Why DeFi Performance Post-Crash is Still a Trap - Deep Dive

2|0 comments

Alright, let's get one thing straight: this whole "flight to safety" narrative in DeFi is total BS.

DeFi's "Winners": Polished Turds on a Sinking Ship?

The Illusion of Safety in a Collapsing Market So, the FalconX report says only *two* out of twenty-three DeFi tokens are up this year? And the "winners" are the ones with buybacks or some "fundamental catalyst?" Give me a break. That's like saying the best lifeboat on the Titanic was the one with slightly fewer holes. Down 37% on average? Quarter-to-date? Sounds like a bloodbath to me. According to a recent report, DeFi tokens have struggled, highlighting shifts and investor behavior DeFi Token Performance & Investor Trends Post-October Crash. They're trying to spin this as some kind of strategic shift, but let's be real—it's just damage control. Investors are panicking and throwing money at anything that *looks* less likely to implode. And this "stickier" lending activity? Please. People are just too scared to pull their money out entirely. It's the financial equivalent of hiding under the covers and hoping the monster goes away. The lending sector’s market cap fell 13%, while fees declined 34%. Investors are crowding lending names in the selloff? It's like musical chairs on a sinking ship.Binance Listings: Desperate Gambles or Just Hopium?

Binance Listings: Hope or Hopium? Then there's this Coinspeaker article hyping up potential Binance listings. Bitcoin Hyper, Maxi Doge, Mantle...sounds like a list of rejected characters from a bad sci-fi movie. Okay, so Binance listings *can* give a token a temporary boost. ASTER saw a 5% rally? Wow, color me impressed. That's like finding a nickel on the sidewalk after getting mugged. Most cryptocurrencies experience a price increase after being listed on Binance, although profit is not guaranteed? No kidding. They're saying Bitcoin Hyper is a "strong candidate" because it aims to be part of Bitcoin DeFi. But wait, is Bitcoin DeFi even a *thing*? Last I checked, Bitcoin was supposed to be, you know, *decentralized*. Now we're trying to shoehorn it into the same broken system we're supposedly escaping? And Maxi Doge? A meme coin? Seriously? We're pinning our hopes on *dog memes*? This is the future of finance? Honestly, the whole thing feels like a casino roll. They go on to detail how the editorial team brings over 10 years of experience in Bitcoin, Ethereum, presales, memecoins, and NFTs, as well as 8 years of experience using Binance since its launch in 2017. So what? That doesn't mean they can predict the future, does it? According to an analysis by Ren & Heinrich, tokens listed on Binance historically gained an average of 41% within 24 hours of announcement. So what? That means nothing. Past performance doesn't guarantee future results, right? And what's this about managing FOMO risk? "Early entries can pay off, but sharp post-listing reversals are common." Translation: get in quick, make a buck, and get out before the whole thing collapses. That's not investing; that's gambling.Jupiter: From Hero to Zero?

JUP: Jupiter's Descent into Mediocrity? Oh, and let's not forget Jupiter (JUP). All-time high of $2, now trading around $0.35? Down in the dumps. This Jupiter price prediction article claims Jupiter is a "core trading tool" in the Solana ecosystem. Fine, maybe it is. But is that enough to justify investing in it? It's a DEX aggregator, which means it finds the best prices across different exchanges. Sounds useful, I guess. But it also sounds like a solution to a problem that shouldn't exist in the first place. Why are prices different across exchanges? Shouldn't DeFi be...you know... *decentralized*? The article says Jupiter launched in 2021 and quickly became a key part of Solana's growth. I'd argue that being a key part of something doesn't make it inherently valuable. The platform launched in 2021 and quickly became a key part of Solana’s growth. It was created by a group of experienced developers led by a pseudonymous figure known as Meow. Okay, so the person in charge of this whole thing wants to remain anonymous? Red flag, anyone? The thing trades around $0.35. Earlier this month, the price dropped to roughly $0.32 on October 17 and climbed to about $0.45 on October 27. It's like a rollercoaster. Is this normal, and what could happen next? Who knows? The article also notes that the social media account was hacked on February 5, which triggered an 8% drop to $0.88. Market confidence took a hit? No kidding. This is All Just a Big, Shiny Distraction I'm starting to think the whole DeFi space is just a massive distraction from the real problems. We're chasing imaginary profits while the world burns around us. Then again, maybe I'm just getting old and cranky. Maybe there's real innovation happening here. Maybe these tokens really *will* change the world. Nah, who am I kidding? So, Where's the Exit? DeFi's not a safe haven; it's a minefield. Binance listings aren't investments; they're lottery tickets. And anyone who tells you otherwise is probably trying to sell you something.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

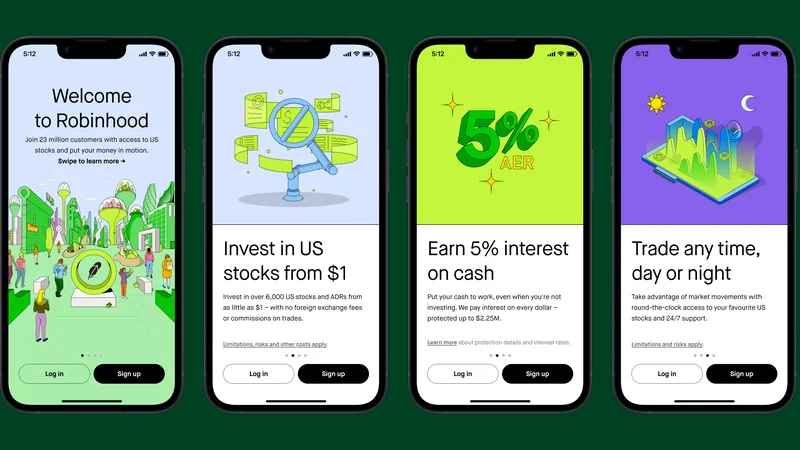

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- Ethereum: Outflows. Momentum. What Gives? - Crypto Twitter Reacts

- Altcoin Season: Three Drivers, One Big Caveat - Debate Ignites

- Ethereum's Fusaka Upgrade: The Vision Unveiled: Why It Redefines Blockchain's Future

- Why DeFi Performance Post-Crash is Still a Trap - Deep Dive

- Why This Altcoin "Rally" Is Just More Hype - Alt Season Incoming!

- Cathie Wood's Crypto Bet: Pure Delusion? - Reddit Hype Train

- Bitcoin's 'Safe Haven' Is Dead: 3 Big Problems. - Twitter Panics

- The Crypto Surging 35% Past Bitcoin: Which one is it, and why is this a pivotal moment?

- Larry Page's Ascent to Second Richest: Net Worth, Current Standing, and the Actual Figures

- Oracle Stock: Unlocking its True Potential and the Road Ahead

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)