Cathie Wood's Crypto Bet: Pure Delusion? - Reddit Hype Train

3|0 comments

Okay, so I'm seeing headlines pop up everywhere: "Should college students invest?" "Best investments for students!" Give me a break. Are we really encouraging broke-ass college kids to throw what little money they have into the stock market? Let's be real about what's going on here.

"Responsible Investing" or Just Another Way to Fleece Students?

The "Responsible Investing" Scam The narrative is always the same: "Start early," "learn about compound interest," "secure your financial future!" It sounds responsible, right? Like we're teaching these kids valuable life skills. But let's cut the crap. We're talking about students, many of whom are already drowning in debt, now being told to risk their tuition money on volatile stocks. What happens when little Timmy loses half his savings on some meme stock? Does Sallie Mae take "Oops, I invested poorly" as a valid excuse for late payments? I doubt it. And don't even get me started on the predatory apps and brokers that are pushing this garbage. They're all too happy to take a cut of every trade, regardless of whether the kid makes or loses money. It's basically gambling disguised as "financial literacy.""Do Your Research" or Just Roll the Dice?

The Illusion of Control They sell this idea that investing is some kind of rational, controlled process. Do your research, diversify your portfolio, and watch the money roll in! Yeah, right. The market is a chaotic beast, driven by forces that nobody—not even the so-called "experts"—fully understands. Telling a college student to "do their research" before investing is like telling them to build a rocket ship after watching a YouTube video. They might learn some buzzwords, but they're still clueless about the underlying mechanics. I mean, let's face it, most "investment advice" is just glorified guesswork. You see some chart that looks promising, you read an article hyping up a company, and you take a shot in the dark. Sometimes you win, sometimes you lose. It's not exactly rocket science, but it's also not something that should be presented as a guaranteed path to riches. Offcourse, there are some success stories of students who got in early on a hot stock and made a killing. But those are the exceptions, not the rule. For every kid who strikes it rich, there are dozens more who end up losing their shirt.College Kids: Fresh Meat for the Wall Street Grinder?

The Real Motivation So, why is everyone so eager to get college students into the stock market? Is it really about financial empowerment? Or is it about something else entirely? I think it's about creating a new generation of gamblers, addicted to the thrill of the market and willing to take risks that they can't afford. It's about feeding the Wall Street machine with fresh blood, lining the pockets of brokers and fund managers who couldn't care less about the financial well-being of these kids. And honestly, it's depressing. We're supposed to be preparing these young people for the future, not turning them into pawns in some financial game. But then again, maybe I'm the crazy one here. Someone's Gotta Pay for Those Yachts Look, I'm not saying that investing is inherently evil. But it's not something that should be pushed on vulnerable college students who are already struggling to make ends meet. There are plenty of other ways for them to build a secure financial future—like, you know, getting a decent job and paying off their student loans. But hey, that doesn't generate as much revenue for the financial industry, does it? I'm just saying, let's be a little more honest about what's really going on here. Let's stop pretending that we're doing these kids a favor by encouraging them to gamble their tuition money on stocks. And let's start focusing on real solutions to the financial challenges they face. Is This Really the Best We Can Do?

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

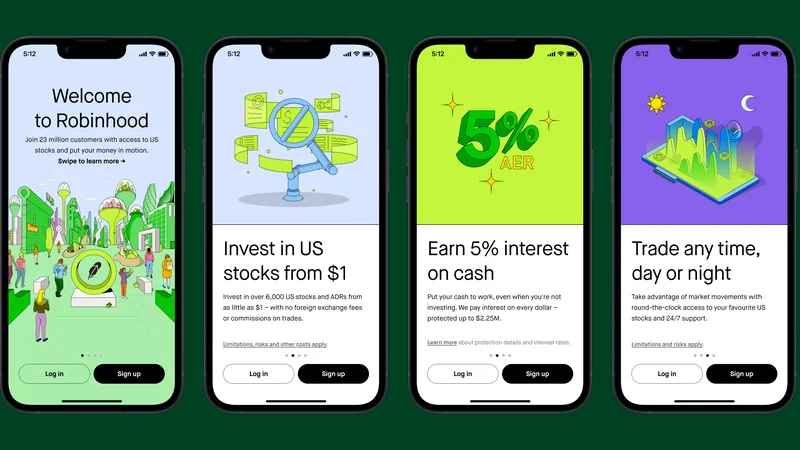

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- Ethereum: Outflows. Momentum. What Gives? - Crypto Twitter Reacts

- Altcoin Season: Three Drivers, One Big Caveat - Debate Ignites

- Ethereum's Fusaka Upgrade: The Vision Unveiled: Why It Redefines Blockchain's Future

- Why DeFi Performance Post-Crash is Still a Trap - Deep Dive

- Why This Altcoin "Rally" Is Just More Hype - Alt Season Incoming!

- Cathie Wood's Crypto Bet: Pure Delusion? - Reddit Hype Train

- Bitcoin's 'Safe Haven' Is Dead: 3 Big Problems. - Twitter Panics

- The Crypto Surging 35% Past Bitcoin: Which one is it, and why is this a pivotal moment?

- Larry Page's Ascent to Second Richest: Net Worth, Current Standing, and the Actual Figures

- Oracle Stock: Unlocking its True Potential and the Road Ahead

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)