Bitcoin's 'Safe Haven' Is Dead: 3 Big Problems. - Twitter Panics

3|0 comments

[Generated Title]: IREN's Wild Ride: Is This Just Another Crypto Pump and Dump?

Alright, let's talk IREN. Up 14.7% because some investment firm, JPMorgan, decided to slap a higher price target on it? Give me a break. We’re supposed to believe this is some genius move based on "optimism for the overall high-performance computing sector"? Sounds like a whole lot of corporate BS to me.

Bitcoin: From Digital Gold to Digital Dumpster Fire?

The Bitcoin Mirage And then there's Bitcoin. Remember when everyone was screaming "digital gold"? Yeah, that aged well. Now it's tanking while actual gold is looking pretty damn shiny. Bitcoin plunges while gold rises, destroying the crypto ‘safe haven’ narrative Deutsche Bank analysts, bless their hearts, were even floating the idea of central banks hoarding Bitcoin. Central banks! Buying something "backed by nothing"! You can’t make this stuff up. So, what happened? Bitcoin ETFs happened. All those retail investors who were too scared to figure out a crypto wallet suddenly jumped in, and now they're running for the hills as fast as they can. And who can blame them? "Every $1 billion that leaves a Bitcoin ETF pulls down the price of Bitcoin by 3.4%" according to some Citi Research guy? Sounds about right. The whole thing feels like a house of cards. Speaking of houses of cards, let's not forget Tether. They're buying up gold like it's going out of style to "back" their USDT stablecoin. So, the crypto world is propping up the gold market? Is that the right way to look at it? Maybe I'm missing something, offcourse, but it seems backwards. It's like using Monopoly money to buy real estate.IREN: Moon Shot or Just Another Overhyped Bubble?

AI Hype vs. Reality And IREN? They swung to a net income of $384.6 million. Good for them. Revenues jumped by 355 percent. Even better. But are they really worth all this hype? Are they really the future of high-performance computing? I don't know, man. It all feels a little too good to be true. Canaccord Genuity slapped a $70 price target on IREN, versus $42 previously. A 44 percent upside potential. JPMorgan's target is $39, which, get this, is *lower* than the current price. So, which is it? Are we headed to the moon, or are we crashing back down to earth? Honestly, I’m starting to think the whole AI thing is getting out of hand. Everyone's throwing money at anything that even vaguely smells like AI, and the market's just going nuts. It reminds me of the dot-com bubble, except instead of pets.com, we've got… well, I don't even know what we've got. Just a lot of companies promising the moon and probably delivering nothing but a pile of vaporware. Maybe I'm just being cynical. Maybe IREN really is the next big thing. But I've seen this movie before, and it usually doesn't end well. It's like believing that one guy who always tells you about his "sure thing" investment, and then you find out he's living in his mom's basement. So, What's the Real Story? Look, I'm not saying IREN is a scam. Maybe it's legit. But the whole situation stinks of a classic pump and dump. Bitcoin's flailing, gold's soaring, and everyone's scrambling to find the next big thing to throw their money at. And honestly, I’m just tired of it.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

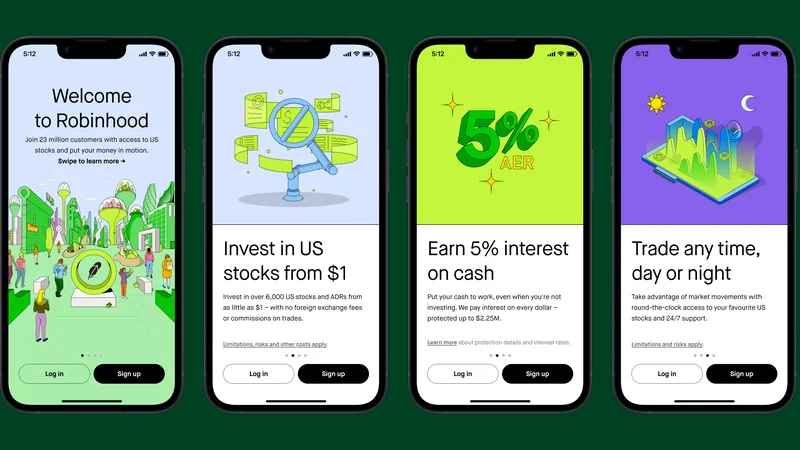

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- Ethereum: Outflows. Momentum. What Gives? - Crypto Twitter Reacts

- Altcoin Season: Three Drivers, One Big Caveat - Debate Ignites

- Ethereum's Fusaka Upgrade: The Vision Unveiled: Why It Redefines Blockchain's Future

- Why DeFi Performance Post-Crash is Still a Trap - Deep Dive

- Why This Altcoin "Rally" Is Just More Hype - Alt Season Incoming!

- Cathie Wood's Crypto Bet: Pure Delusion? - Reddit Hype Train

- Bitcoin's 'Safe Haven' Is Dead: 3 Big Problems. - Twitter Panics

- The Crypto Surging 35% Past Bitcoin: Which one is it, and why is this a pivotal moment?

- Larry Page's Ascent to Second Richest: Net Worth, Current Standing, and the Actual Figures

- Oracle Stock: Unlocking its True Potential and the Road Ahead

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)