Larry Page's Ascent to Second Richest: Net Worth, Current Standing, and the Actual Figures

From Search Engine to Second Richest: Did AI Write This Rally?

Larry Page, the name synonymous with search, has now added another title to his resume: world's second-richest person. According to Forbes, Page’s net worth reached an estimated $267.5 billion this week, surpassing Oracle’s Larry Ellison. The catalyst? A continued surge in Alphabet's (Google’s parent company) stock price, fueled by investor enthusiasm for its AI initiatives. Larry Page Passes Larry Ellison Becoming World’s Second-Richest

Shares of Alphabet climbed over 6% on Monday, and the rally continued, driven by reports that Meta Platforms (Facebook) is considering using Google's AI chips in its data centers. The stock is up nearly 70% this year, outperforming most other megacaps. Even Salesforce CEO Marc Benioff gave a shoutout to Google's Gemini AI model on X (formerly Twitter), which is something you don't see every day (CEOs rarely promote their competitors). The question is, is this rally built on solid ground, or is it another case of AI hype driving irrational exuberance?

The Gemini Effect: Separating Hype from Reality

Google's new Gemini 3 AI model is being touted as a major driver of this stock surge. Industry benchmarks supposedly show it edging out OpenAI's ChatGPT. However, let's dig a bit deeper. Benchmarks are useful, but they don’t always reflect real-world performance. How much of this surge is based on actual increased revenue and efficiency driven by Gemini, and how much is simply investor speculation? (It’s difficult to say with certainty, but I suspect the latter plays a significant role.)

The numbers are impressive. Page's net worth jumped nearly $15 billion in a single session, bringing him to an estimated $272 billion. It’s a dramatic climb from his $50.9 billion net worth in 2020. But here's the rub: this isn't purely about AI prowess. Meta's potential use of Google's AI chips plays a significant role, suggesting that Alphabet's infrastructure and cloud services are just as crucial as its AI models. The surge isn’t just about Gemini; it's about Google's overall position as a provider of AI solutions.

The Broader Tech Landscape and Alphabet's Position

The tech landscape is currently dominated by AI fever. Companies are scrambling to integrate AI into their products and services, and investors are rewarding those perceived to be leading the charge. This creates a self-fulfilling prophecy, where rising stock prices attract more investment, further inflating valuations.

Alphabet's rise also highlights a shift in the tech hierarchy. The company is close to reaching a $4 trillion market capitalization. This valuation places it in direct competition with Microsoft, a long-time tech leader. It also begs the question: Is this sustainable? Can Alphabet maintain this level of growth and innovation, or will it eventually be overtaken by another company riding the next wave of technological advancement?

The rise of Larry Page also casts a spotlight on the concentration of wealth in the tech industry. He and Sergey Brin, who co-founded Google in 1998, now control fortunes that eclipse those of established business titans like Larry Ellison. This raises broader societal questions about wealth distribution and the impact of technology on the economy. And this is the part of the story that I find genuinely unsettling. We’re talking about wealth accumulation at a scale that was unimaginable just a few decades ago. How much of this wealth is truly "earned," and how much is a result of being in the right place at the right time during a period of unprecedented technological innovation?

Is This an AI Bubble Waiting to Burst?

The data paints a clear picture: Larry Page's rise to become the world's second-richest person is directly tied to Alphabet's AI-fueled stock surge. While Google's AI innovations are undoubtedly impressive, a significant portion of this surge seems driven by investor hype and speculation. The market is rewarding companies perceived to be winning the AI race, and Alphabet is currently in the lead. But as with any technological revolution, there's always the risk of a bubble. The question isn't whether AI is transformative (it is), but whether current valuations accurately reflect the long-term potential and profitability of these AI ventures.

The AI Gold Rush

Larry Page's ascent is a symptom of a larger trend. We're in the midst of an AI gold rush, where investors are throwing money at anything that glitters with the promise of artificial intelligence. While the long-term potential of AI is undeniable, the current market frenzy is likely unsustainable. A correction is inevitable, and when it comes, some of these high-flying tech companies (Alphabet included) may find themselves crashing back down to earth.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

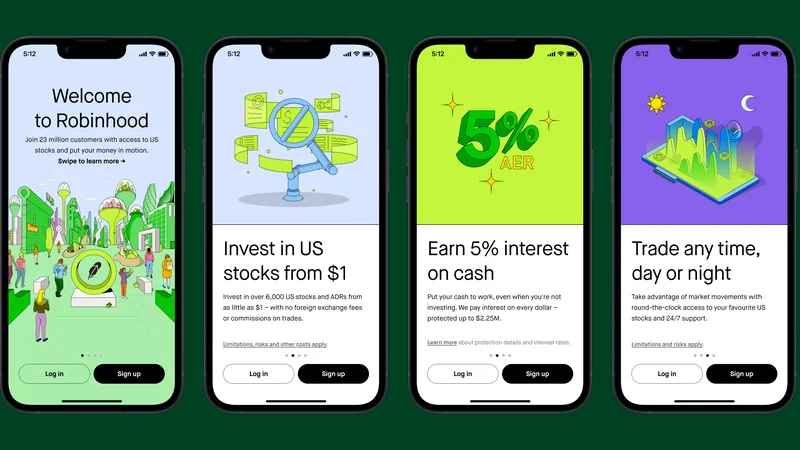

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- Ethereum: Outflows. Momentum. What Gives? - Crypto Twitter Reacts

- Altcoin Season: Three Drivers, One Big Caveat - Debate Ignites

- Ethereum's Fusaka Upgrade: The Vision Unveiled: Why It Redefines Blockchain's Future

- Why DeFi Performance Post-Crash is Still a Trap - Deep Dive

- Why This Altcoin "Rally" Is Just More Hype - Alt Season Incoming!

- Cathie Wood's Crypto Bet: Pure Delusion? - Reddit Hype Train

- Bitcoin's 'Safe Haven' Is Dead: 3 Big Problems. - Twitter Panics

- The Crypto Surging 35% Past Bitcoin: Which one is it, and why is this a pivotal moment?

- Larry Page's Ascent to Second Richest: Net Worth, Current Standing, and the Actual Figures

- Oracle Stock: Unlocking its True Potential and the Road Ahead

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)