Google Stock: Why It's Soaring and What It Means

Apple and Alphabet's Record Highs: Are We Witnessing a Tech Renaissance?

The stock market's been on a rollercoaster this month, hasn't it? But amidst all the ups and downs, a few giants are quietly rewriting the narrative. Apple and Alphabet, reaching record highs—it's not just about the numbers; it's a sign, a signal that something profound is shifting beneath the surface of the tech world. And I, for one, am incredibly excited about what it means.

Forget the daily market jitters for a moment. Let's talk about why these companies are surging. Alphabet's rise, in particular, is fascinating. While everyone's been hyper-focused on Nvidia and the AI chip race, Google's been playing a longer, smarter game. They're not just building AI; they're building the infrastructure around AI, offering their in-house chips to companies like Meta. Think about that for a second. It's like selling shovels during the gold rush, except the "shovels" are cutting-edge AI accelerators. The company is inching closer to a $4 trillion market cap. What does this mean for future innovation?

The Vertical Integration Advantage

This brings me to my "Big Idea": vertical integration. Google isn't just developing AI models; they're controlling the entire stack, from the silicon to the software. It's a strategy that gives them an unparalleled level of control, efficiency, and, ultimately, competitive advantage. To me, it’s like Henry Ford realizing he needed to control the rubber plantations to build cars at scale. It's not enough to just use the best technology; you have to own the best technology.

And that's where the real magic happens. When you control the entire pipeline, you can optimize every single step, squeezing out efficiencies and innovations that others simply can't match. Imagine, for a moment, the possibilities: AI models that are perfectly tailored to Google's hardware, and hardware that's designed from the ground up to run those models with maximum performance. The speed of this is just staggering—it means the gap between today and tomorrow is closing faster than we can even comprehend.

The market is starting to recognize this. As one analyst put it, "Google has a level of AI vertical integration that even the other big tech companies can’t quite match." But here's the thing: it's not just about Google. Apple's record high is another piece of the puzzle. It suggests a broader trend: a flight to quality, a recognition that companies with strong fundamentals, clear strategies, and, yes, vertical integration, are best positioned to thrive in the long run. Stock market today: Dow, S&P 500, Nasdaq rally for 3rd day as Fed rate cut hopes grow, Apple and Alphabet notch records

Of course, there are challenges. Nvidia's stock dipped on the news of Meta potentially using Google's AI chips, highlighting the intense competition in this space. And let's be honest, the concentration of power in the hands of a few tech giants raises important ethical questions. How do we ensure that these technologies are used for the benefit of all, not just a select few? It’s a question we need to address head-on.

But here's where I get really excited. Remember the early days of the internet? There was this sense of boundless possibility, a feeling that anything was possible. I feel that same energy bubbling up again now. The convergence of AI, cloud computing, and vertical integration is creating a new wave of innovation, and Apple and Alphabet are leading the charge.

A Glimpse of What's Coming

These stock surges aren't just about money; it’s about a validation of a vision. It's about the power of technology to transform our world, to solve our biggest problems, and to create a future that's brighter than we ever imagined. And I, for one, can't wait to see what happens next.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

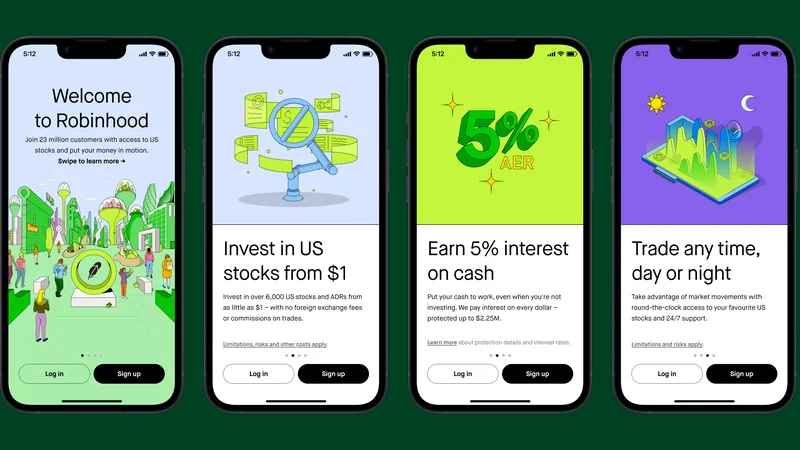

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- Ethereum: Outflows. Momentum. What Gives? - Crypto Twitter Reacts

- Altcoin Season: Three Drivers, One Big Caveat - Debate Ignites

- Ethereum's Fusaka Upgrade: The Vision Unveiled: Why It Redefines Blockchain's Future

- Why DeFi Performance Post-Crash is Still a Trap - Deep Dive

- Why This Altcoin "Rally" Is Just More Hype - Alt Season Incoming!

- Cathie Wood's Crypto Bet: Pure Delusion? - Reddit Hype Train

- Bitcoin's 'Safe Haven' Is Dead: 3 Big Problems. - Twitter Panics

- The Crypto Surging 35% Past Bitcoin: Which one is it, and why is this a pivotal moment?

- Larry Page's Ascent to Second Richest: Net Worth, Current Standing, and the Actual Figures

- Oracle Stock: Unlocking its True Potential and the Road Ahead

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)