Altcoin Season: Three Drivers, One Big Caveat - Debate Ignites

2|0 comments

Altcoin season is upon us, or so the headlines proclaim. But before we jump on the bandwagon, let's dissect what's actually driving this purported rally. Is it just hype, or is there real substance behind the surge? Several factors are being touted as catalysts: the Federal Reserve's potential interest rate cuts, corporate treasury activity, and regulatory clarity. But a closer look reveals a more nuanced picture.

Rate Cuts: Altcoin Lifeline or Just Wishful Thinking?

Interest Rate Cuts and Market Liquidity One narrative suggests that lower interest rates, spurred by the Fed, will inject liquidity into the crypto market, benefiting risk-on assets like altcoins. This is a standard macro argument, and while it holds some water, it's not a guaranteed win. The CME FedWatch tool indicates investors expect a 0.25% rate cut. A 0.5% cut? That's a long shot, but the market's pricing it in as a potential upside surprise. Kyle Chasse, founder of MV Global, suggests a bigger cut might trigger a significant rally. But how significant? And for how long? These are the questions that require cold, hard data, which, unfortunately, is often lacking in these analyses.Cronos Pumps: Trump's Golden Ticket?

The Trump Card and Beyond Then there's the curious case of Cronos (CRO), the native token of the Crypto.com platform. Its recent surge is attributed to a partnership with Trump Media, the company behind Truth Social. Trump Media plans to integrate Crypto.com’s wallet infrastructure and adopt CRO as a utility token. The companies will also exchange investments: Trump Media will buy $105 million in CRO (~2% of supply), and Crypto.com will acquire $50 million in DJT shares. The deal includes creating a $6.4 billion treasury focused on CRO accumulation, instantly making it one of crypto's most ambitious corporate treasury plays.Cronos: Trump Pump or Legitimate Liftoff?

Cronos (CRO) Analysis The token is up more than 120% in the last seven days, now trading for $0.31. Why? The Trump pump, naturally. Here's where things get interesting. The article notes that CRO's Relative Strength Index (RSI) is at 89, which is "severely overbought territory." This often signals an impending correction. The Average Directional Index (ADX) for Cronos is at 39, indicating a powerful trend. ADX measures trend strength, regardless of direction, on a scale from 0 to 100. Anything above 25 confirms a trend, and anything above 40 is considered a very strong trend. But as anyone who's been in the market long enough knows, "overbought" can stay overbought for longer than you think, especially with this kind of news catalyst. The question is: How much of this rally is sustainable, and how much is pure speculation driven by the Trump name? I've looked at hundreds of these filings, and the speed with which the treasury was built is unusual.Institutional Love: A $326 Million "Maybe"

Institutional Buying and Solana (SOL) Institutional buying is another purported driver. Galaxy Digital, for instance, acquired roughly $326 million worth of Solana (SOL) for Multicoin’s digital asset treasury strategy. Reports suggest Galaxy still holds over $1.3 billion in cash and stablecoins to continue building the position. This kind of large-scale buying undoubtedly creates demand and reinforces Solana's position. But, let's be clear, it's not charity. Galaxy expects a return on this investment. If Solana doesn't deliver, that $326 million could just as easily flow out. Altcoin Season: Pudgy, Solana, Jupiter Rally on CatalystsWallet Integrations: Utility Boost or Just a Feel-Good Story?

Wallet Integrations and Token Utility Finally, there's the argument that wallet integrations, like Jupiter Lend's expansion into Binance Wallet, boost access and utility, driving up the price of tokens like Jupiter (JUP). This makes sense on the surface. More users, more demand, higher price. But the devil's in the details. How many new users are actually being onboarded through these integrations? What's the average transaction volume of these new users? Without these metrics, it's just a feel-good story.Altcoin Season: A Hint, Not a Guarantee (Yet)

Altcoin Season Index Analysis The Altcoin Season Index from CoinMarketCap is currently at 53 out of 100, up from a low of 12 in April. The index hit a whopping 87 points back in December 2024. That's a significant increase, suggesting *something* is happening. But it's not definitive proof of a full-blown altcoin season. Bitcoin dominance has declined from 65% in May to 59% in August. This decline in BTC dominance—when Bitcoin's share of total crypto market cap shrinks—is the classic harbinger of altcoin season.Altcoin Surge: Real Rotation or Just Speculative Mania?

Is It a Genuine Rotation, Or Just a Mirage? The data paints a mixed picture. There are genuine catalysts at play: institutional buying, corporate partnerships, and increased usability through wallet integrations. But there's also a healthy dose of hype and speculation, particularly around tokens associated with high-profile figures like Donald Trump. The key is to separate the signal from the noise. Are these altcoins building sustainable ecosystems with real-world utility, or are they just riding the wave of short-term market sentiment?Altcoin "Season": Hype or Sustainable Growth?

Just Another Flash in the Pan? The "altcoin season" narrative is compelling, but the data suggests caution. While some altcoins are showing genuine momentum, much of the rally appears to be driven by hype and speculation. Until we see more concrete evidence of sustained growth and real-world utility, it's best to approach this "season" with a healthy dose of skepticism.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

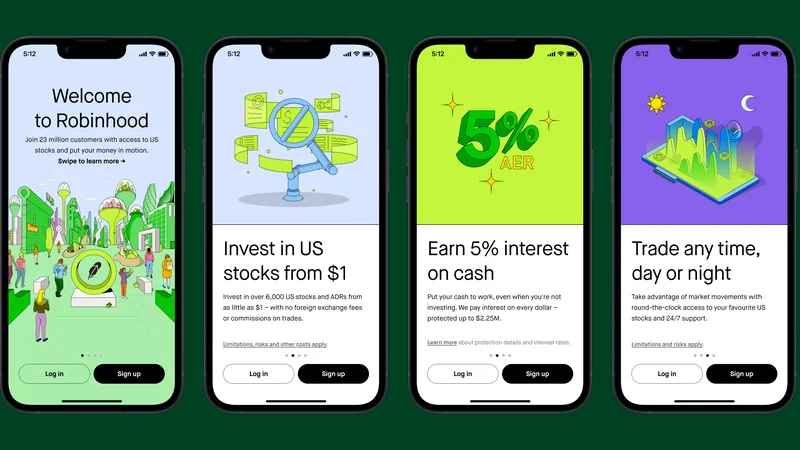

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- Ethereum: Outflows. Momentum. What Gives? - Crypto Twitter Reacts

- Altcoin Season: Three Drivers, One Big Caveat - Debate Ignites

- Ethereum's Fusaka Upgrade: The Vision Unveiled: Why It Redefines Blockchain's Future

- Why DeFi Performance Post-Crash is Still a Trap - Deep Dive

- Why This Altcoin "Rally" Is Just More Hype - Alt Season Incoming!

- Cathie Wood's Crypto Bet: Pure Delusion? - Reddit Hype Train

- Bitcoin's 'Safe Haven' Is Dead: 3 Big Problems. - Twitter Panics

- The Crypto Surging 35% Past Bitcoin: Which one is it, and why is this a pivotal moment?

- Larry Page's Ascent to Second Richest: Net Worth, Current Standing, and the Actual Figures

- Oracle Stock: Unlocking its True Potential and the Road Ahead

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)