NIO Stock: Price Today and Latest News

NIO's Narrowing Losses: A Glimpse of Stability or a Mirage?

NIO, the Chinese EV maker vying for dominance alongside XPeng and Li Auto, just released its Q3 earnings. The headline? A smaller net loss—CNY 3.66 billion (about $515.3 million), down from CNY 5.14 billion the previous year. That’s better than the CNY 3.71 billion loss analysts were expecting, according to Visible Alpha. So, is this a turnaround story, or just clever accounting?

Let's dig into the numbers. While a narrower loss is undoubtedly positive, it's crucial to examine how they achieved it. The report cites "strong sales" and "improved margins." Okay, but how strong and how improved? These are the questions that keep analysts up at night. According to the Wall Street Journal, NIO Net Loss Narrows on Strong Sales, Margin.

Improved margins are particularly interesting in a market as cutthroat as China's EV sector. Tesla is perpetually slashing prices, and everyone else is scrambling to keep up. How did NIO buck that trend? Did they find some magical cost-cutting measure, or are they sacrificing something else – say, R&D spending or long-term investments – to make the numbers look better now? (That's a classic move to boost nio stock price short term, but it can be a disaster in the long run.)

The Devil in the Details: Sales vs. Profitability

The core question is sustainability. Can NIO maintain this trajectory? A single quarter of improvement doesn't negate previous losses, nor does it guarantee future success. The EV market is notoriously volatile. Government subsidies can disappear overnight, consumer preferences shift on a dime, and a new competitor can emerge from nowhere.

I've looked at hundreds of these filings, and the reliance on "strong sales" as the primary driver of improved financials always makes me nervous. Sales volume is one thing; profitable sales are another. Are they selling more cars at a lower profit margin, or are they actually increasing profitability per vehicle? The report doesn’t explicitly break this down, which is…convenient.

And this is the part of the report that I find genuinely puzzling. Why isn’t there more transparency on the specific drivers of margin improvement? Is it a reduction in raw material costs? Better manufacturing efficiency? Or simply a shift towards higher-margin vehicle models? Details on this remain scarce, but the market reaction suggests investors are cautiously optimistic. The nio stock price today reflects this, but caution is needed.

Beyond the Balance Sheet: The Bigger Picture

What about the broader context? NIO isn't operating in a vacuum. They're competing against Tesla, BYD, and a host of other domestic players. They're also subject to the whims of the Chinese government, which can be both a boon and a bane. (Remember the regulatory crackdown on tech companies a few years back?) And what about the global economy? A recession could severely impact demand for luxury EVs, regardless of how well NIO is managing its internal operations.

Moreover, NIO's brand perception plays a crucial role. Are they seen as a premium brand, a value brand, or something in between? Brand equity is notoriously difficult to quantify, but it has a direct impact on pricing power and customer loyalty. The Tesla stock, for example, benefits from their brand image.

So, Is This a Real Recovery?

The narrowing net loss is a positive sign, no doubt. But it's just one data point. A single quarter doesn't make a trend. We need to see consistent improvement over several quarters to truly declare a turnaround. And even then, we need to be wary of external factors that could derail their progress. It's like seeing a single green shoot after a long winter: encouraging, but it doesn't mean spring has arrived.

A Glimmer of Hope, Not a Victory Parade

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

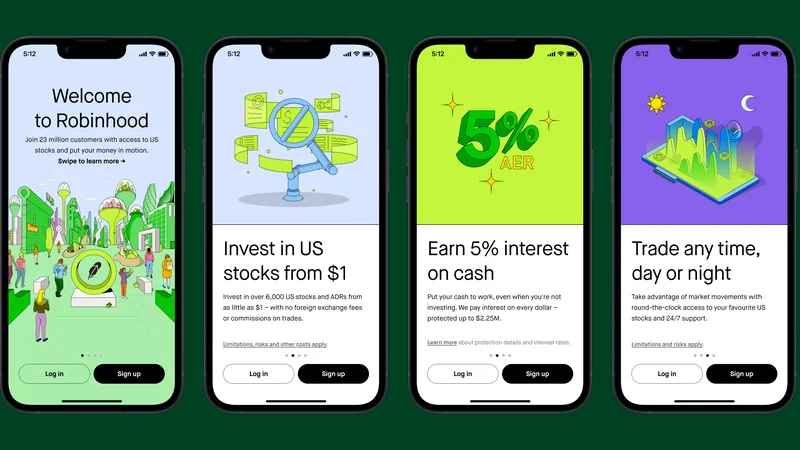

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- Ethereum: Outflows. Momentum. What Gives? - Crypto Twitter Reacts

- Altcoin Season: Three Drivers, One Big Caveat - Debate Ignites

- Ethereum's Fusaka Upgrade: The Vision Unveiled: Why It Redefines Blockchain's Future

- Why DeFi Performance Post-Crash is Still a Trap - Deep Dive

- Why This Altcoin "Rally" Is Just More Hype - Alt Season Incoming!

- Cathie Wood's Crypto Bet: Pure Delusion? - Reddit Hype Train

- Bitcoin's 'Safe Haven' Is Dead: 3 Big Problems. - Twitter Panics

- The Crypto Surging 35% Past Bitcoin: Which one is it, and why is this a pivotal moment?

- Larry Page's Ascent to Second Richest: Net Worth, Current Standing, and the Actual Figures

- Oracle Stock: Unlocking its True Potential and the Road Ahead

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)