PPI Inflation: What It Means for Markets Amid the Cancelled GDP Report

Title: The Day the Data Died: How a Missing GDP Report Exposed the Market's House of Cards

The markets hate uncertainty. That's a given. But what happens when not just uncertainty, but a complete absence of key economic data throws everything into chaos? November 25, 2025, might be remembered as the day the data died—or at least, the day the market realized how much it relies on information it takes for granted.

The Phantom GDP and the Oversized PPI

The Producer Price Index (PPI) report, usually a second-tier economic indicator, suddenly found itself thrust into the spotlight. Why? Because the Q3 GDP report was MIA. The official explanation: the government shutdown prevented data collection. (A convenient excuse, some might say.) Without the GDP as an anchor, the PPI became the market's primary signal. The PPI came in at 2.6%, slightly better than the expected 2.7%. Normally, that's a blip. On this day, it was gospel.

Think of it like this: the GDP is the engine of a car, and the PPI is the oil pressure gauge. You need both to understand what's happening. Without the engine data, everyone's obsessing over the oil pressure, trying to infer the speed and direction of the car from a single, limited reading. The market "rallied," as they say, but on what basis? A single data point, amplified by the void left by the missing GDP.

Then there's the curious case of BlackRock's pre-PPI Bitcoin dump. A whale like BlackRock moving 4,471 BTC (worth over $400 million) right before the report raises eyebrows. Was it insider trading, as some online speculated? Hard to say definitively (and I'm not making any accusations). But it certainly adds another layer of murk to the already opaque situation. The lack of transparency fuels suspicion.

A Market on a Knife's Edge

The S&P 500 was already at a critical juncture, technically speaking. It had broken down from a six-month channel the previous week. The PPI report became the deciding factor: would it invalidate the breakdown and trigger a new upward movement, or confirm the downtrend? The market's reaction to the PPI put it on a knife's edge. A strong rally could have sparked a bullish reversal. A rejection would have sent the index tumbling nearly 9% to the $6,125 level.

The anecdotal data from social media reflected this anxiety. "Traders are on high alert," one tweet read. Everyone was hanging on the PPI's every digit. The absence of the GDP report turned the PPI into a Rorschach test: investors saw in it what they wanted to see, projecting their hopes and fears onto a single, imperfect metric.

And this is the part I find genuinely puzzling. Why was the market so reliant on the U.S. GDP? German GDP growth had already fallen to 0% that quarter. Shouldn't investors have been looking at a broader range of global indicators? The singular focus on the U.S. data suggests a certain level of—dare I say—parochialism in the market's thinking. (Or, perhaps, a desperate search for any kind of solid ground.)

The Robot in the Room

There's another, more unsettling possibility lurking beneath the surface. The articles about the PPI report include a strange, almost surreal, interjection: repeated "Are you a robot?" checks. These CAPTCHA-like prompts suggest that automated systems were heavily involved in scraping and analyzing the data. As Bloomberg reported, the U.S. Producer Price Index increased 0.3%, led by higher energy costs.

Consider this: if algorithms are making split-second trading decisions based on a single, potentially flawed data point, amplified by the absence of other key information, are we really in control of the market? Or are we just passengers in a car driven by a very sophisticated, but ultimately unthinking, machine?

A Glitch in the Matrix

The missing GDP report wasn't just an inconvenience; it was a stress test. It revealed the market's over-reliance on single data points, the potential for algorithmic misinterpretation, and the ever-present specter of human manipulation (or at least, well-timed Bitcoin dumps). It's a reminder that even in the age of big data, a little missing information can expose the fragility of the entire system.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

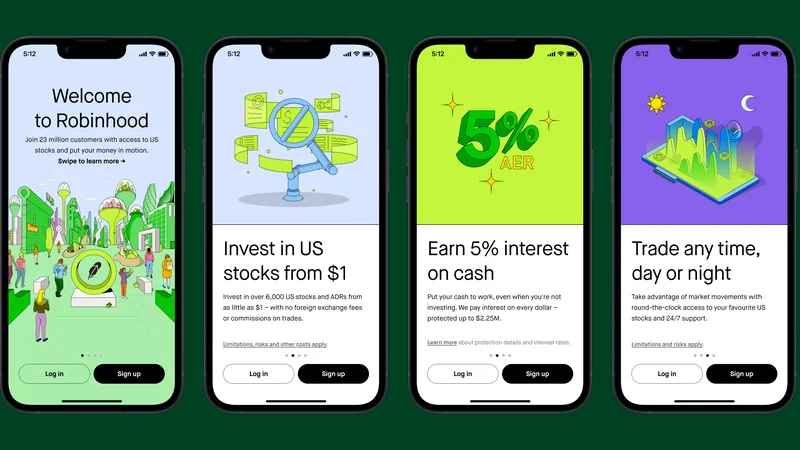

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- Ethereum: Outflows. Momentum. What Gives? - Crypto Twitter Reacts

- Altcoin Season: Three Drivers, One Big Caveat - Debate Ignites

- Ethereum's Fusaka Upgrade: The Vision Unveiled: Why It Redefines Blockchain's Future

- Why DeFi Performance Post-Crash is Still a Trap - Deep Dive

- Why This Altcoin "Rally" Is Just More Hype - Alt Season Incoming!

- Cathie Wood's Crypto Bet: Pure Delusion? - Reddit Hype Train

- Bitcoin's 'Safe Haven' Is Dead: 3 Big Problems. - Twitter Panics

- The Crypto Surging 35% Past Bitcoin: Which one is it, and why is this a pivotal moment?

- Larry Page's Ascent to Second Richest: Net Worth, Current Standing, and the Actual Figures

- Oracle Stock: Unlocking its True Potential and the Road Ahead

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)