NIO Stock: The Latest Numbers & What's Next for Its Price

NIO's Q3: Is the "Accelerated Growth" Narrative Believable?

NIO (NYSE: NIO) just dropped its Q3 2025 numbers, and the initial market reaction was positive. Shares jumped in premarket trading. The headline figures? Revenue up 16.7% year-over-year to RMB21.79 billion (around US$3.06 billion), and deliveries up 40.8% to 87,071 units. On the surface, it looks like the company is finally gaining some serious traction in the EV market. But let's dig a little deeper, shall we?

Digging Into the Delivery Numbers

The press release is keen to highlight the "all-around competitiveness" of NIO's multi-brand strategy (NIO, ONVO, and FIREFLY). And it's true, the delivery breakdown tells an interesting story: 36,928 NIOs, 37,656 ONVOs, and 12,487 FIREFLYs. The ONVO brand, aimed at families, is nearly matching the flagship NIO brand in volume. FIREFLY, the small, "high-end" car, is also contributing a respectable chunk. But here's where the narrative starts to get a bit murky.

NIO is projecting Q4 deliveries between 120,000 and 125,000 vehicles – a 65.1% to 72.0% year-on-year increase. That's ambitious. To hit that target, they'll need to significantly ramp up production across all three brands. The CEO claims they're "working closely with supply chain partners," but details on how this ramp-up will be achieved remain scarce. Are they opening new factories? Optimizing existing lines? The report doesn't say. Also, is it sustainable to keep relying on new models to drive growth? What happens when the "new car smell" wears off, and consumers move on to the next shiny object?

One thing that is impressive is the vehicle margin, which improved to 14.7% in Q3 2025, compared to 13.1% in the third quarter of 2024 and 10.3% in the second quarter of 2025. According to the report, this is primarily thanks to decreasing material costs per unit, which is primarily driven by the Company’s comprehensive cost reduction efforts.

The Profitability Puzzle

Now, let's talk about the elephant in the room: profitability. NIO is still losing money – a net loss of RMB3.48 billion (US$488.9 million) for the quarter. That's a decrease from the RMB5.06 billion loss in Q3 2024, which is progress. The adjusted net loss (excluding share-based compensation and organizational optimization charges) also improved, down to RMB2.74 billion (US$384.2 million). The company is touting "continuous cost optimization," and the numbers seem to back that up. But how much of this "optimization" is sustainable, and how much is just one-time cost-cutting?

Here's a question that I haven't seen addressed elsewhere: R&D expenses are down significantly – 28% year-over-year. While cost control is good, cutting R&D in a rapidly evolving industry like EVs seems risky. Are they sacrificing long-term innovation for short-term gains? It’s a classic trade-off, and I'm not sure they're making the right call.

And this is the part of the report that I find genuinely puzzling. They're improving margins and cutting costs, but they're still bleeding cash. The report mentions "positive operating cash flow" during the quarter, but also notes negative operating cash flow in the first two quarters of 2025. Which one is it? Positive or negative? This is the kind of discrepancy that makes me raise an eyebrow.

The company completed a US$1.16 billion equity offering in September, which has bolstered their balance sheet. Cash and equivalents stand at RMB36.7 billion (US$5.1 billion). That buys them some breathing room. But it also means existing shareholders got diluted. Is this really the best way forward?

Reading Between the Lines

Management is painting a rosy picture, talking about a "new cycle of accelerated growth." But I'm not entirely convinced. The EV market in China is fiercely competitive. NIO isn't just battling established players like Tesla, but also a growing number of domestic rivals like Xpeng.

The report mentions that the "All-New NIO ES8 has set the fastest record for delivering over 10,000 units among BEVs priced above RMB400,000 in China." That sounds impressive, until you remember that "fastest record" only applies to a very specific niche: expensive BEVs in China. It's a classic example of cherry-picking data to create a favorable narrative. NIO Stock: Why Shares Jumped After Latest Earnings Beat

The technical sentiment for the stock is currently rated as "hold". Year-to-date, the stock has gained 26.37% in performance. The narrowing loss per share aligns with analyst expectations for continued improvement. Market watchers are projecting even smaller losses in upcoming quarters.

Optimism Tempered by Reality

The improved delivery numbers and margins are encouraging, no doubt. But NIO still has a long way to go before it achieves sustainable profitability. The projected Q4 delivery numbers are ambitious, and the long-term impact of R&D cuts remains to be seen.

Ultimately, the question is this: Can NIO translate its top-line growth into bottom-line profits? Or will it continue to rely on debt and equity offerings to stay afloat? The next few quarters will be crucial in determining whether NIO's "accelerated growth" narrative is based on substance or just wishful thinking.

Show Me a Profit, Then We'll Talk

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

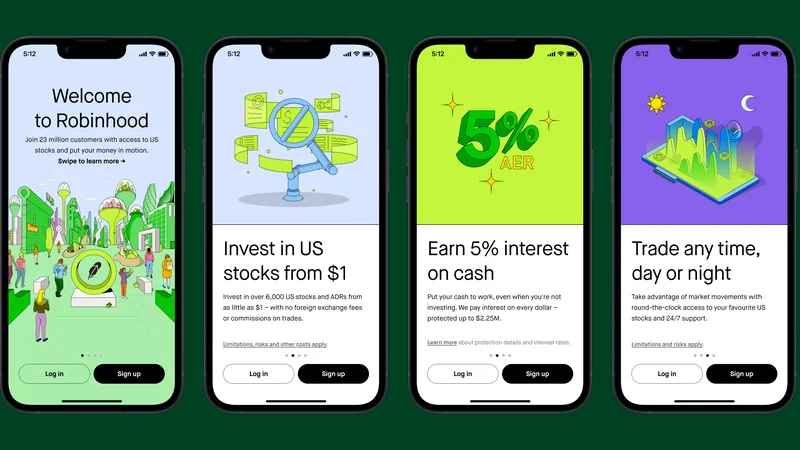

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- Ethereum: Outflows. Momentum. What Gives? - Crypto Twitter Reacts

- Altcoin Season: Three Drivers, One Big Caveat - Debate Ignites

- Ethereum's Fusaka Upgrade: The Vision Unveiled: Why It Redefines Blockchain's Future

- Why DeFi Performance Post-Crash is Still a Trap - Deep Dive

- Why This Altcoin "Rally" Is Just More Hype - Alt Season Incoming!

- Cathie Wood's Crypto Bet: Pure Delusion? - Reddit Hype Train

- Bitcoin's 'Safe Haven' Is Dead: 3 Big Problems. - Twitter Panics

- The Crypto Surging 35% Past Bitcoin: Which one is it, and why is this a pivotal moment?

- Larry Page's Ascent to Second Richest: Net Worth, Current Standing, and the Actual Figures

- Oracle Stock: Unlocking its True Potential and the Road Ahead

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)