Google Stock: The 'AI Rally' and What They're Not Telling You

Alright, so the Nasdaq had a "S&P 500 rips 1.6% higher, Nasdaq posts best day since May as Alphabet reignites AI trade" because Alphabet reignited the AI trade? Give me a break. Are we really still falling for this song and dance?

The Market's Pavlovian Response

Every time some tech company sneezes in the general direction of "artificial intelligence," the market goes nuts. It's like we're all a bunch of Pavlov's dogs salivating at the sound of a bell. Broadcom, AMD, Micron, Tesla, Google—they all jumped. The Nasdaq jumped 2.7%. Big deal.

And what exactly constitutes "reigniting the AI trade," anyway? Did Alphabet suddenly invent Skynet? Did they finally figure out how to make a self-driving car that doesn't try to merge into oncoming traffic? I seriously doubt it. It's probably just another overhyped demo that will never actually materialize into anything useful.

It's the same old story: promise the moon, deliver a slightly shinier version of what we already have, and rake in the profits.

Then again, maybe I'm being too cynical. Maybe this time it's different. Nah, who am I kidding?

Rate Cuts and Trump's "Very Good" Call

Of course, the AI hype wasn't the only thing driving the market. We also had San Francisco Fed President Mary Daly and Fed governor Christopher Waller talking about cutting interest rates next month. Oh, joy. More cheap money to fuel the next bubble.

And let's not forget President Trump's "very good telephone call with President Xi." Because a single phone call is all it takes to solve geopolitical tensions, right? I'm sure everything is fine now.

It's all so predictable. A little bit of good news here, a little bit of hype there, and suddenly everyone is convinced that the good times are back. Never mind the fact that inflation is still a problem, the global economy is still shaky, and we're all basically one black swan event away from another financial crisis.

Speaking of black swan events, I'm still waiting for someone to explain how Bitcoin is trading at $89,000 after having its worst weekly loss since February. That whole thing still feels like a house of cards waiting to collapse.

Offcourse, all this market volatility reminds me of my neighbor's dog who chases his tail endlessly. It's frenetic activity that leads absolutely nowhere.

The Cookie Monster Economy

While all this is happening, NBCUniversal is busy tracking our every move with cookies. I mean, seriously, who actually reads those cookie notices? "Strictly Necessary Cookies," "Personalization Cookies," "Ad Selection and Delivery Cookies"... it's a never-ending list of ways they're trying to figure out how to sell us more crap we don't need.

It's all part of the same game. The AI hype, the market rallies, the endless tracking... it's all designed to keep us distracted, keep us consuming, and keep the money flowing to the top.

So, What's the Real Story?

It's all a carefully orchestrated illusion. They want us to believe that everything is under control, that the future is bright, and that we should all just keep buying the dip. But let's be real—it's a f*ing mess.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

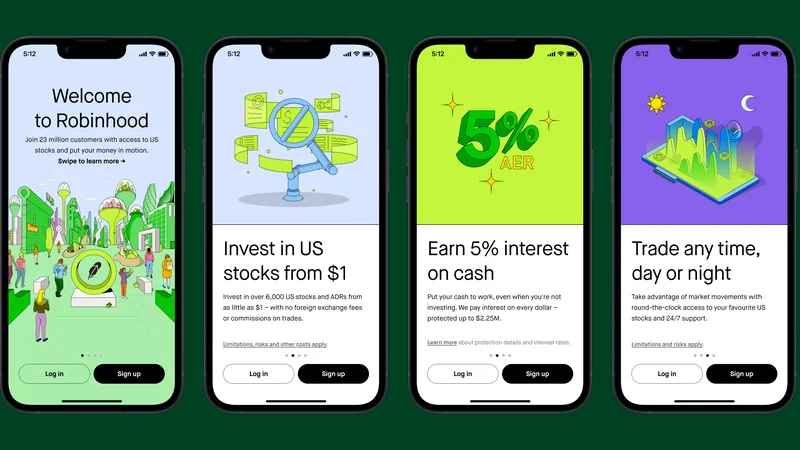

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- Ethereum: Outflows. Momentum. What Gives? - Crypto Twitter Reacts

- Altcoin Season: Three Drivers, One Big Caveat - Debate Ignites

- Ethereum's Fusaka Upgrade: The Vision Unveiled: Why It Redefines Blockchain's Future

- Why DeFi Performance Post-Crash is Still a Trap - Deep Dive

- Why This Altcoin "Rally" Is Just More Hype - Alt Season Incoming!

- Cathie Wood's Crypto Bet: Pure Delusion? - Reddit Hype Train

- Bitcoin's 'Safe Haven' Is Dead: 3 Big Problems. - Twitter Panics

- The Crypto Surging 35% Past Bitcoin: Which one is it, and why is this a pivotal moment?

- Larry Page's Ascent to Second Richest: Net Worth, Current Standing, and the Actual Figures

- Oracle Stock: Unlocking its True Potential and the Road Ahead

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)