VTI Stock: Price & VOO Performance

[Generated Title]: VTI: Is This Rally Fool's Gold? A Data Dive.

The Vanguard Total Stock Market ETF (VTI) is a popular choice for investors seeking broad exposure to the U.S. equity market. Recent data paints a mixed picture, one that requires a closer look beyond the headlines. Let's dive into the numbers and see if this rally is built on solid ground or something a little more…tenuous.

Performance vs. Perception

VTI is up 13% year-to-date, which sounds impressive. But, as always, context is key. The fund is actually down 1.74% over the past five days. This immediately raises a red flag. Are we looking at a temporary dip or the start of a trend reversal? Moreover, while VTI saw net inflows of $336 million over the last five days, that doesn't tell us who is buying. Are these institutional investors making strategic allocations, or retail investors chasing recent gains? The "smart money" versus the "dumb money," as they say.

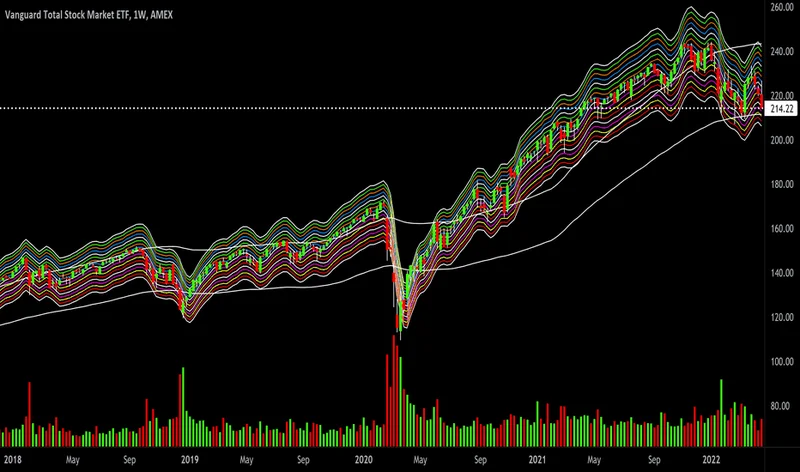

And here's where I find the data slightly unsettling. TipRanks technical analysis gives VTI a "Neutral" rating overall, but a "Sell" rating based on moving average consensus. This discrepancy suggests a lack of conviction among technical analysts. VTI is currently trading at $323.80, below its 50-day exponential moving average of $327.30. A bearish signal, plain and simple. Is this a minor correction, or the market telegraphing something more significant?

The Weight of Giants

VTI's performance is heavily influenced by its top holdings: Nvidia (NVDA), Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), and Broadcom (AVGO). These five stocks alone account for a significant portion of the ETF's total value. If these giants stumble, VTI will feel the pain. NVDA, for example, makes up a whopping 7.14% of the fund. That's a lot of weight resting on one company's shoulders.

Caterpillar (CAT) and Goldman Sachs (GS) have significantly outperformed both the VOO and VTI this year. These Dow Stocks Have Crushed the VOO and VTI in 2025—Here’s Where They’re Headed Next CAT is up over 56% year to date, and GS is up over 36%. But can this momentum continue? CAT's business is cyclical, and GS relies heavily on dealmaking. If the economy slows down or M&A activity dries up, these stocks could easily lose their luster.

I've looked at hundreds of these ETF breakdowns, and the concentration of holdings in VTI is not necessarily unique, but it does amplify the risk. It's like building a house on a foundation with a few very large, but potentially unstable, cornerstones.

Analyst Optimism vs. Market Reality

TipRanks' ETF analyst consensus gives VTI a "Moderate Buy" rating, with an average price target of $392.91, implying a 21.3% upside. But this consensus is based on a weighted average of analyst ratings on VTI's holdings, not on a direct analysis of the ETF itself. This is a crucial distinction. The ETF could be less than the sum of its parts.

And here's the part that I find genuinely puzzling: VTI's Smart Score is seven, implying that it's likely to perform in line with the broader market. But if analysts are so bullish on its holdings, why isn't the Smart Score higher? This suggests that either the analyst ratings are overly optimistic, or that the market sees risks that the analysts are missing.

A Calculated Gamble, Not a Sure Thing

The data is mixed. VTI offers broad market exposure, but its performance is heavily dependent on a few key stocks. Analyst optimism is tempered by technical indicators and market realities. While the ETF may offer long-term growth potential, investors should be aware of the risks and avoid chasing short-term gains. It's a calculated gamble, not a sure thing.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

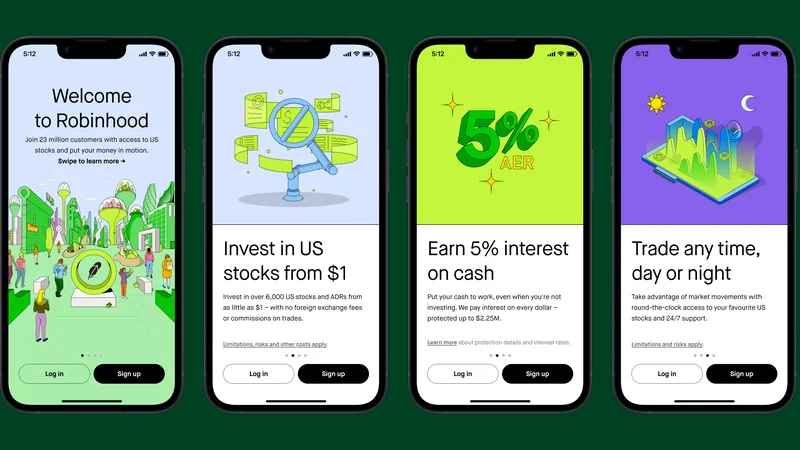

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- Ethereum: Outflows. Momentum. What Gives? - Crypto Twitter Reacts

- Altcoin Season: Three Drivers, One Big Caveat - Debate Ignites

- Ethereum's Fusaka Upgrade: The Vision Unveiled: Why It Redefines Blockchain's Future

- Why DeFi Performance Post-Crash is Still a Trap - Deep Dive

- Why This Altcoin "Rally" Is Just More Hype - Alt Season Incoming!

- Cathie Wood's Crypto Bet: Pure Delusion? - Reddit Hype Train

- Bitcoin's 'Safe Haven' Is Dead: 3 Big Problems. - Twitter Panics

- The Crypto Surging 35% Past Bitcoin: Which one is it, and why is this a pivotal moment?

- Larry Page's Ascent to Second Richest: Net Worth, Current Standing, and the Actual Figures

- Oracle Stock: Unlocking its True Potential and the Road Ahead

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)