Blockchain Finance: The Data Doesn't Lie - Finance Shook?

1|0 comments

From Gamer's Grievance to $430 Billion Behemoth

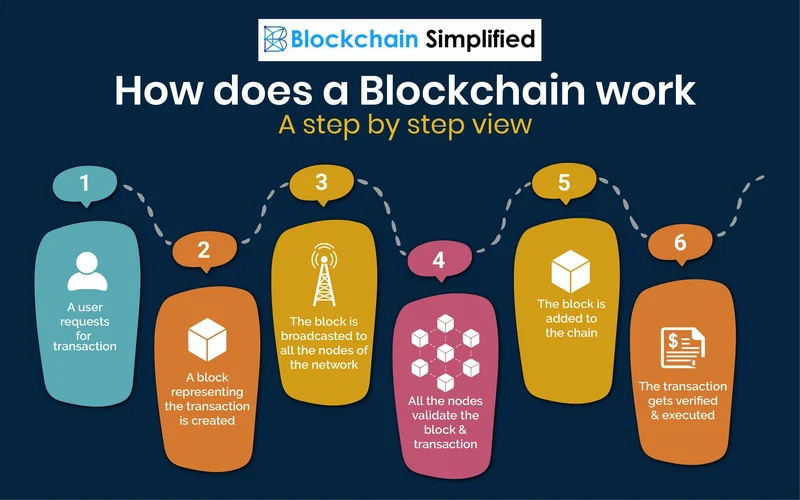

Ethereum's Decade of Disruption On July 30th, 2025, Ethereum hits the big 1-0: a decade since its launch. From a niche project born out of a gamer's frustration with World of Warcraft (seriously) to a $430 billion behemoth, its journey is a wild one. The narrative is simple: Vitalik Buterin, a disillusioned 15-year-old, dreams of a decentralized future, discovers Bitcoin, and then supersizes it with "smart contracts." These contracts, automated programs that execute on their own, are the bedrock of everything from DeFi to NFTs. The early days weren't all sunshine and roses. A 2016 hack of "The DAO," a smart contract, resulted in a $150 million loss—a sum that would make any investor sweat. The community's response? A hard fork, essentially rewriting the blockchain's history to undo the damage. This created Ethereum Classic (ETC) for the purists who believe in immutability above all else. This split is a crucial moment. It highlights the inherent tension between the ideals of decentralization and the pragmatic need for intervention when things go south. Was it a necessary save, or a fatal compromise of blockchain's core promise? Then came the boom. Decentralized Finance (DeFi) platforms emerged, offering lending, borrowing, and trading services without traditional intermediaries. Non-Fungible Tokens (NFTs) exploded onto the scene, reaching peak absurdity with CryptoKitties in 2021—digital collectibles that were part Tamagotchi, part Pokémon. The Merge in 2022 was another landmark, slashing Ethereum's energy consumption by a reported 99% (CoinShares Research's claim, not mine, though the actual reduction is generally accepted as substantial). Now, major corporations treat ETH like digital gold. BitMine Immersion Technologies, backed by the likes of Peter Thiel and Cathie Wood, holds over $1 billion in ETH. SharpLink Gaming and GameSquare also hold six-figure positions. Spot Ethereum ETFs, approved in the U.S. in mid-2024, have opened the floodgates for institutional investment. These ETFs hold actual ETH tokens (unlike futures ETFs) and closely track the underlying price.Ethereum at 10: Reign or Relinquish?

The Elephant in the Blockchain: Competition Ethereum's dominance isn't guaranteed. Projects like Solana are nipping at its heels, and even Bitcoin is evolving. While Ethereum boasts 96 million wallets, the crypto landscape is constantly shifting. Can Ethereum maintain its lead as the programmable blockchain of choice? Paul Brody, global blockchain leader at EY, pointed out last year that the Ethereum blockchain ecosystem processed $2 trillion in stablecoin payments in a single month, with over 99% of that in U.S. dollars. That’s a massive figure, but it also highlights a key point: much of Ethereum's activity is tied to the U.S. dollar, a centralized currency. Is this a strength or a vulnerability? If stablecoins become heavily regulated, or if a central bank digital currency (CBDC) gains traction, could Ethereum's stablecoin-driven activity be threatened? Brody also notes the importance of stablecoins in emerging markets, where demand for U.S. dollars is high due to inflation or lack of independent central banks. This suggests a potential for Ethereum to play a significant role in global finance, particularly in cross-border remittances. Traditional systems can take days and cost a fortune; stablecoin transfers are nearly instantaneous and dirt cheap. 3 Ways Cryptocurrency Could Change How You Manage Your Money Within a Decade. However, the question remains: can Ethereum overcome its inherent challenges, like scalability and transaction fees (which can still be high during peak usage)? The shift to proof-of-stake was a step in the right direction, but further improvements are needed to handle mass adoption. And this is the part of the report that I find genuinely puzzling: why haven't transaction fees been solved yet? Brody emphasizes that every bank will soon offer some kind of DLT (distributed ledger technology) service. Banks that rely on credit card transaction fees are most at risk, as blockchains offer a more efficient alternative. But regional banks focused on corporate finance may see less disruption. Major custody banks, like BNY Mellon and JPMorgan, have an opportunity to help tokenize assets and manage them in different ecosystems. Paul Brody, EY: How Blockchain Is Transforming Global Commerce The King Still Has to Fight for His Throne Ethereum's 10th anniversary is a milestone, but it's also a reminder that the crypto landscape is constantly evolving. The network's journey from a gamer's frustration to a Wall Street darling is impressive, but its future success depends on its ability to adapt, innovate, and overcome its inherent challenges. Will it remain the king of programmable blockchains, or will another project dethrone it? Only time—and the data—will tell.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

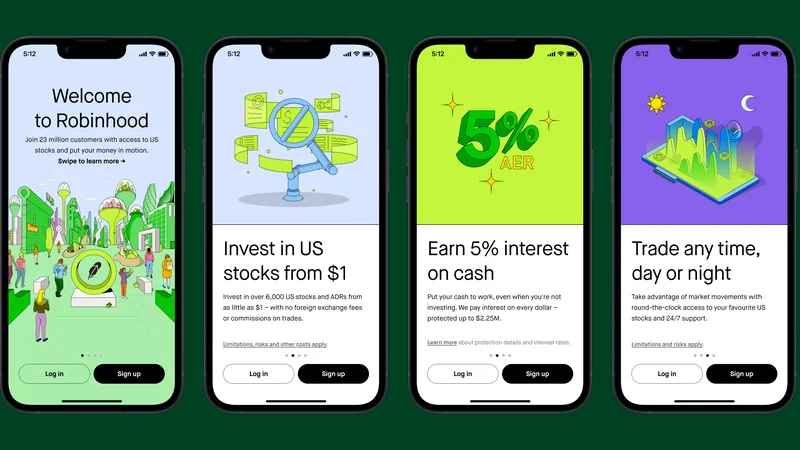

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- DeFi Tokens Post-October Crash: Performance, Investor Trends, and the 2025 Wake-Up Call

- Blockchain Finance: The Data Doesn't Lie - Finance Shook?

- Ethereum: Outflows. Momentum. What Gives? - Crypto Twitter Reacts

- Altcoin Season: Three Drivers, One Big Caveat - Debate Ignites

- Ethereum's Fusaka Upgrade: The Vision Unveiled: Why It Redefines Blockchain's Future

- Why DeFi Performance Post-Crash is Still a Trap - Deep Dive

- Why This Altcoin "Rally" Is Just More Hype - Alt Season Incoming!

- Cathie Wood's Crypto Bet: Pure Delusion? - Reddit Hype Train

- Bitcoin's 'Safe Haven' Is Dead: 3 Big Problems. - Twitter Panics

- The Crypto Surging 35% Past Bitcoin: Which one is it, and why is this a pivotal moment?

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)